The great advantages of the solar equipment tax credit are twofold.

New york state solar panel tax credit.

For you to claim the new york state personal tax credit the system must be installed at your personal residence.

Please consult your tax adviser regarding income tax credit eligibility.

For instance if your system costs 15 000 you d be able to take a 3 750 tax credit on your state taxes.

New york state solar equipment tax credit.

You are able to install solar panels reduce the cost of your bills and receive a few extra incentives that can help with tax credits as well.

However any credit amount in excess of the tax due can be carried over for up to five years.

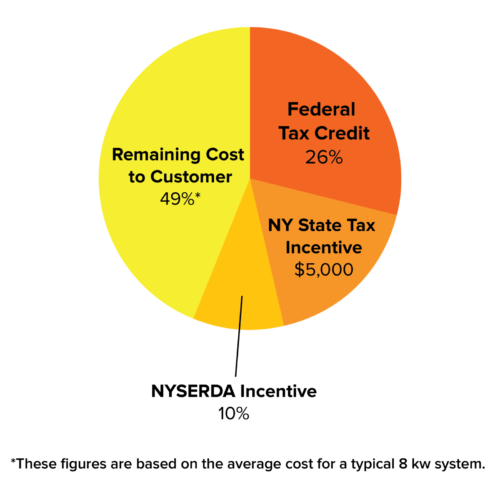

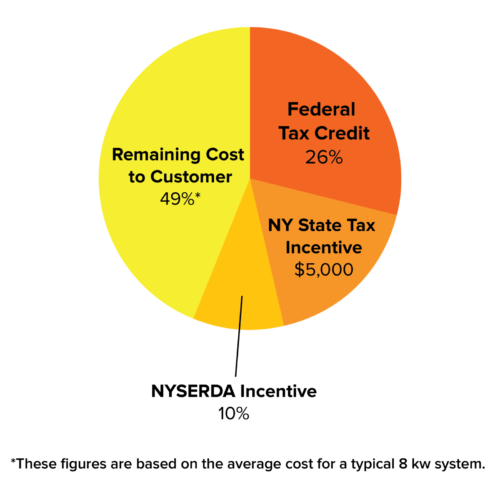

The new york solar tax credit can reduce your state tax payments by up to 5 000 or 25 off your total solar energy expenses whichever is lower.

Federal solar tax credit incentives the federal incentives provided to new york homeowners are very beneficial.

7 if you don t pay enough in taxes to claim the credit in a year the excess credit will carry over to the following year.

Community solar is not eligible for the new york state personal tax credit.

Download new york state forms and instructions.

New york solar sales tax exemption.

First you don t have to purchase your system to claim the credit i e.

The solar energy system equipment credit is not refundable.

It applies to you even if you went solar with a lease or ppa.

25 new york state tax credit.

The credit is equal to 25 of your qualified solar energy system equipment expenditures and is limited to 5 000.